Environmental activists say recycling metals for the energy transition would enable the planet to completely circumvent the type of deep-sea mining (DSM) plans approved by the Norwegian parliament, But critics say there is no way that circularity can ever address the massive supply shortfalls envisioned.

On the same day as Norway's decision, the Environmental Justice Foundation (EFJ) released a report claiming existing technologies can facilitate recovery rates of up to 90% of minerals such as cobalt, lithium, manganese and nickel - popular targets for seabed miners. The NGO claims a lack of policy frameworks and infrastructure are preventing this option from being fully pursued.

EFJ's report has been met with criticism by both minerals supply experts and proponents of DSM, who say there simply aren't enough minerals in existing supply chains to make recycling a viable alternative.

Is recycling realistic?

EJF's report argues that the growing demand for critical minerals, particularly for electric vehicles, can be met through circular economy strategies such as extending product life, repair for second-life uses and recycling.

"Recycling and other circular economy strategies can play a significant role in reducing demand for critical minerals and should be the primary focus of industry and government efforts," EJF notes.

"This would both increase supply chain security by reducing dependence on major suppliers such as China, and reduce the negative impacts of primary extraction."

EJF cites research that found circular economy strategies can reduce mineral demand by 58% between 2022 to 2050.

DSM enthusiasts argue that a lack of critical minerals in the current economy means that even if recycling efforts were ramped up, there just aren't enough materials to fuel the energy transition, particularly as the demand for batteries skyrockets.

"The problem is that in order to meet the world's demand for critical minerals and metals within a timeline of 5-25 years, there is not enough metals to recycle," said Egil Tjåland, associate professor at the Department of Geoscience and Petroleum at the Norwegian University of Science and Technology and secretary general of the Norwegian Forum for Marine Minerals.

Lithium demand is expected to reach 2.5-3 million tons by 2030, according to both the World Economic Forum and the International Energy Agency (IEA). Global production in 2022 reached just 130,000 tons, according to the USGS (United States Geological Survey.

Tjåland adds: "According to the IEA's Net Zero report from 2021, there is a demand to have a large proportion of EV cars globally within 2030, a demand that will create a need for battery metals much larger than can be produced by recycling alone within such a short time frame. For longer time spans, the problem is even bigger."

The IEA estimates that even by 2040, secondary production from recycled minerals could account for up to just 12% of total supply requirements for cobalt, around 7% for nickel, and 5% for lithium and copper. The projected contribution of reused batteries is smaller, reaching only 1-2% of total supply requirements for each mineral in 2040.

"DSM is actually likely to accelerate the amount of material that can be recycled," said Craig Shesky, the chief financial officer of sea exploration firm, The Metals Company.

"With EV batteries having a seven-year-plus life and then maybe a second use attached to homes and the grid, how can EJF claim that material would be available for a market that needs to be 4-6 times bigger within the next two decades? You can't recycle your way into supply growth."

While EJF's report acknowledges that primary extraction will be needed before recycling becomes a mainstream solution, it maintains that the deep sea is not where we should be looking for our resources.

"Primary extraction will still, however, play a role in the clean energy transition - especially in the interim, before recycled metals become readily available. [But] there are also critical knowledge gaps about the deep sea and the impacts of DSM that prevent fully informed, science-based decision-making," the report notes.

Robotics revolution

In recent years, several studies have highlighted the potential dangers of extracting resources from the seafloor. In a 2019 study published in Scientific Reports, researchers used a robot submarine to observe the site of a deep-sea mine nearly 30 years after operation. They found that tracks from equipment were still visible, and many animals living attached to the seafloor were missing.

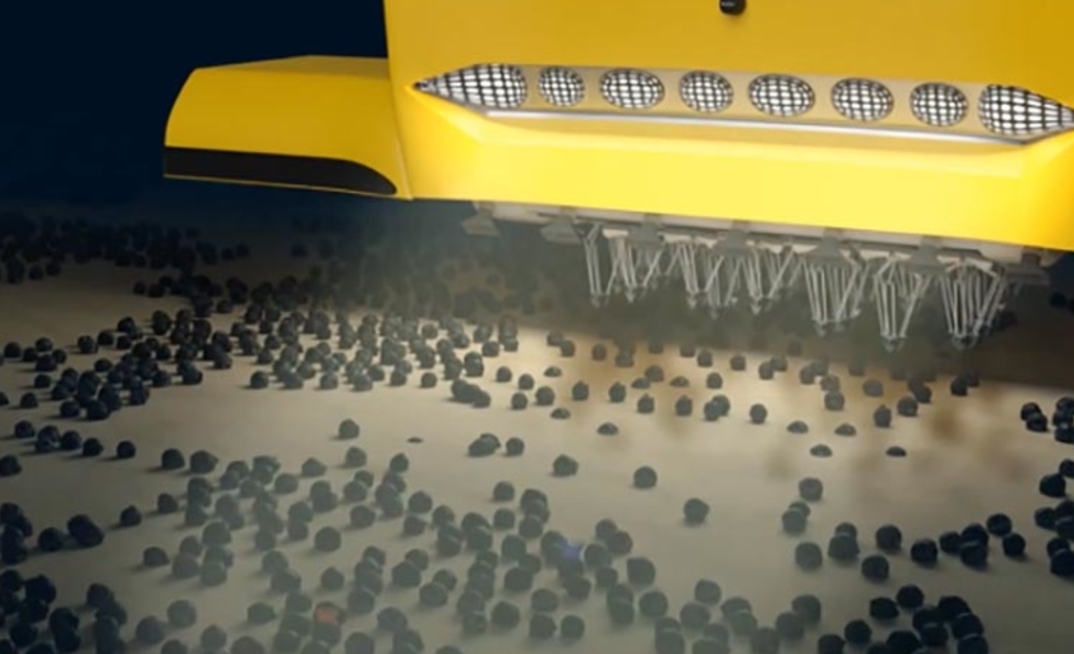

A primary concern is that mining may remove polymetallic nodules, which are potato-shaped rocks that provide a home for many animals. Without these nodules, the animals will have nowhere to live, and the ecosystem will be disrupted.

However, others argue that recent advances in DSM have clarified environmental risks and also highlighted potential benefits.

For instance, DSM technology company Impossible Metals is currently developing a machine learning-enabled robotic arm that will facilitate the selective harvesting of polymetallic nodules and minimise the disturbance of sediments and the seafloor.

Speaking with Mining Magazine in December, Shesky also noted that materials from the sea may have a lower carbon footprint than other sources.

"Nickel, for instance, is going to be coming from an area of the planet with the highest species richness - you're talking about rainforest mining. Benchmark Minerals did a life-cycle analysis on this topic and found that (...) there was an 80% reduction in CO2 emissions per tonne of nickel from [sea] nodules compared to, let's say, Indonesian nickel," Shesky said.

"If EJF is right [about recycling], then nodules are just a lower cost and lower impact source of supply of these metals, and the market will balance," Shesky said. "If they are wrong, they have gambled the planet's future by trying to pre-emptively stop one of the only scalable sources of these metals."