A recent study published in the Heliyon journal sheds light on the structure of the global mineral governance system, revealing a fascinating network of power and cooperation between countries.

The research, conducted by a team of scientists from the Chinese Academy of Geological Sciences, analysed the participation of 114 countries in 40 international organisations related to minerals.

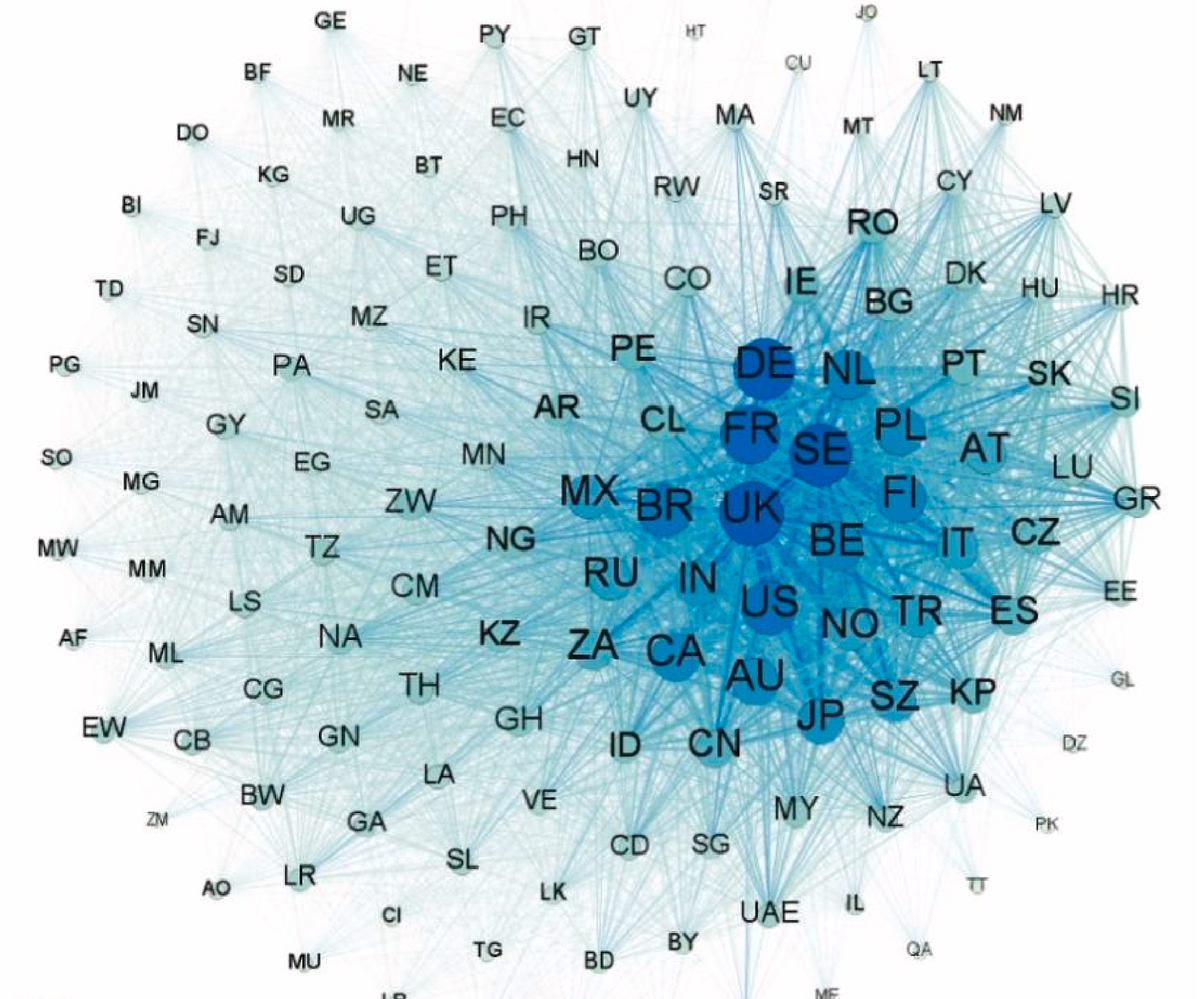

By mapping the connections between countries based on their membership in these organisations, the researchers identified four main groups of players.

The dominant but cooperative

A first grouping comprises countries such as the UK, France, Germany, Sweden, and Canada.

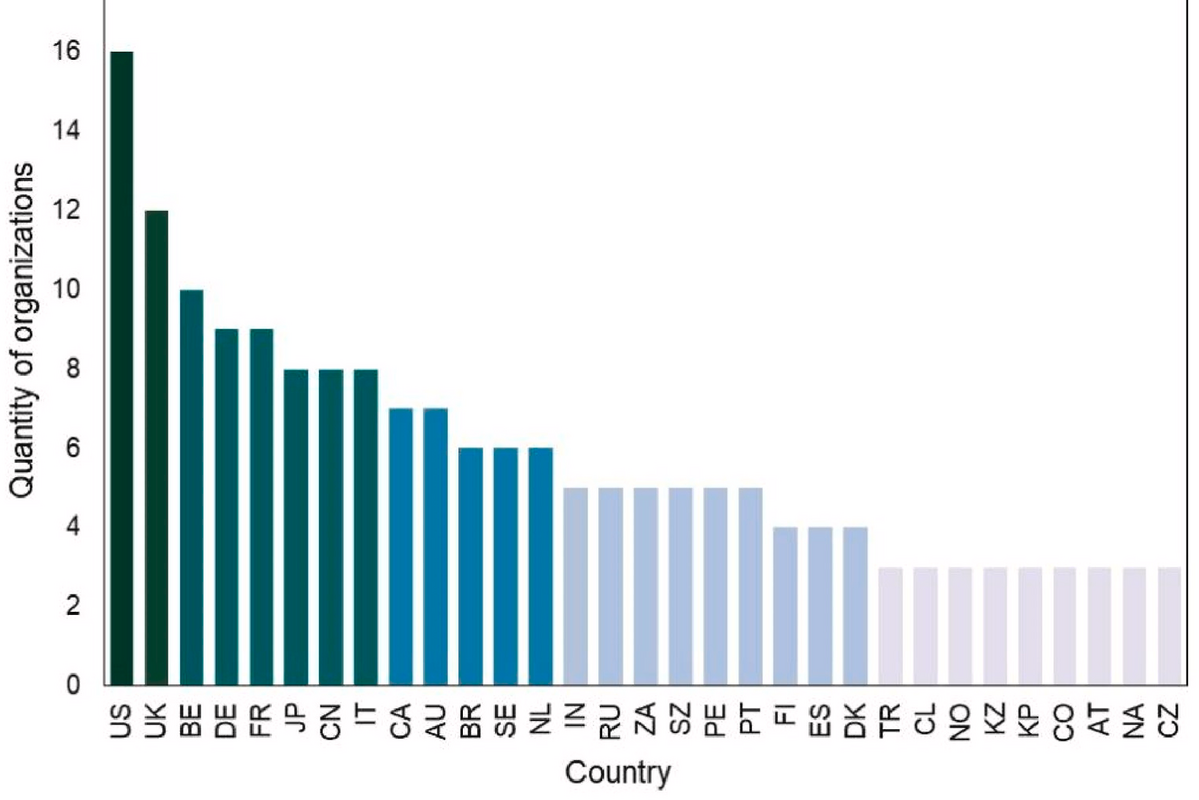

This group actively participates in and even leads certain organisations, leveraging their economic and political clout to shape the rules and direction of the governance system. For instance, the UK's high nodal importance and the quantity of organisations in which it serves as a board member suggest that it is not only active but also capable of setting the core rules and strategic direction of the organizations.

The UK has both cooperative and dominant capacity in the governance system. France, Germany, and Sweden follow closely behind, exhibiting high nodal importance and board membership. Canada also holds a significant position in the network due to its high intermediation and serves as a board member in several organizations.

Fig. 1. Quantities of organisations with country serving as board member. Source: Chinese Academy of Geological Sciences,

"European countries are the early pioneers in global governance, having constructed a series of international systems through rules and orders. They use their long-accumulated experience to dominate global governance in cooperation with authoritative international organizations such as the WTO, the G7, the World Bank

"Concurrently, Europe is a region with shortcomings in mineral resource endowment, limited production of metal products, and the rapid development of the economy and science and technology, leading to a serious degree of external dependence on some of its mineral resources."

The strong cooperators

Secondly, there are emerging economies like Brazil, Mexico, South Africa, Russia, and India that demonstrate high levels of engagement in the system and are significant due to their status as mineral resource producers, notes the report. They act as vital bridges between different groups and contribute to the overall efficiency of cooperation.

These countries hold importance in the network due to their high intermediation or cooperation efficiency and high motivation to participate. However, they do not have a strong dominant capacity due to the low quantity of organisations in which they serve as directors.

"The mining industry plays a vital role in their economic development but also brings about a host of economic, social, and political challenges. To address these issues, on the one hand, these countries have joined market research groups or alliances for minerals' supply to discuss production, trade, price and other issues related to mineral resources with consumer countries; on the other hand, as important suppliers of mineral resources.

"[However] these countries face a series of issues related to responsible and sustainable exploitation of mineral resources, such as human-rights violations, environmental pollution, gender inequality, and corruption in the industry."

The dominant, but less engaged

The US and China fall into this 'dominant but unmotivated' category. While they hold significant power in the system by virtue of their board memberships in key organisations, their overall participation and engagement are relatively low.

The United States' position in the global mineral landscape is a key example of this curious mix of dominance and dependence. Despite being a top producer, consumer, and trader of minerals, the US relies heavily on imports for many crucial resources. According to USGS data, over 60% of 63 mineral products are imported, with 17 completely reliant on foreign sources. These minerals are vital for both the US economy and national security.

To address this dependence, the US has actively pursued partnerships with allies and resource-producing nations. Initiatives like the Energy Resource Governance Initiative, the Mineral Security Partnership, and the Alliance for Sustainable Critical Minerals demonstrate this commitment to securing supply chains and fostering sustainable mineral development.

However, while the US boasts strong collaborative ties with developed nations and resource-rich partners like Canada and Australia, its network with other regions, particularly Africa and South America, remains limited. This lack of diversity weakens its cooperative capacity. In essence, the US stands as a powerful player in the global mineral game yet faces the unique challenge of balancing dependence on imports with its leadership position in shaping the rules of the industry.

Fig. 2 National cooperation network based on international organisations. Source Chinese Academy of Geological Sciences

The marginalised players

Many African, South American, and some European countries fall into this final group. They lack the resources or capacity to actively participate in the system, leaving them on the periphery of decision-making.

"Most African and South American countries have low global economic power and political standing and do not have a voice and competitiveness in the global mining market.

"At the same time, the stage of economic development determines that these countries have a limited willingness to participate in global governance and do not have sufficient capital strength and governance capacity to be integrated into the current governance system, rendering them weak in both cooperative and dominant capacities."

The researchers said that although certain countries, such as the Democratic Republic of the Congo and Zimbabwe, have high production for some minerals like cobalt and gold, their poor geopolitical situation has prevented them from becoming central players in the governance system.

Global governance crunch

The research highlights the need for further investigation into the factors influencing the different roles and levels of engagement of countries in the system.

It also underlines that the global mineral governance system is a delicate dance of cooperation and power, where resource wealth, economic might, and political influence determine each nation's position on the stage. Understanding these dynamics will be crucial for navigating the future of responsible and sustainable development in mining.