Mining arbitration cases rising

Resource nationalism, security risks, and regulatory shifts are driving a surge in mining arbitration cases.

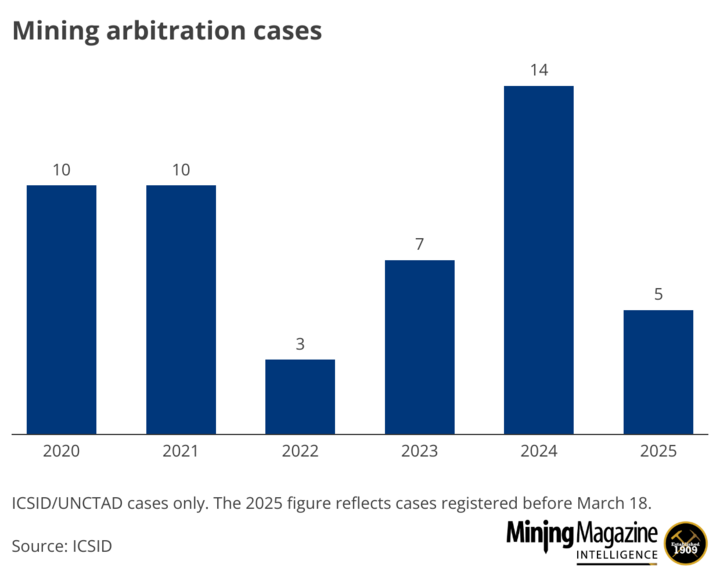

More than 50 arbitration cases relating to mining were registered between 2020 and mid-March 2025, according to an analysis of data from the World Bank's International Centre for the Settlement of Investment Disputes (ICSID) by Mining Journal Intelligence (MJI).

Cases reached a peak of 14 in 2024.

While First Quantum Minerals' decision this week to pause a US$20 billion arbitration claim against Panama relating to the closure of its Cobre Panamá copper mine signals a potential de-escalation between the two parties, arbitration cases globally are on track to hit a new high, with five lodged in the first 11 weeks of 2025.

Global cases

Of the 54 mining arbitration cases registered since the start of 2020, 36 remain pending, with 18 concluded. The true number of cases will be significantly higher, as the ICSID database only includes those registered with the centre itself and UN Trade and Development (UNCTAD). Some other tribunals, such as the International Chamber of Commerce (ICC), were not included in the analysis as they publish limited information about cases.

Arbitration cases may indicate a spike in investment risk, often reflecting rising resource nationalism or regulatory changes that negatively impact mining and exploration companies.

Arbitration hotspots: Mexico

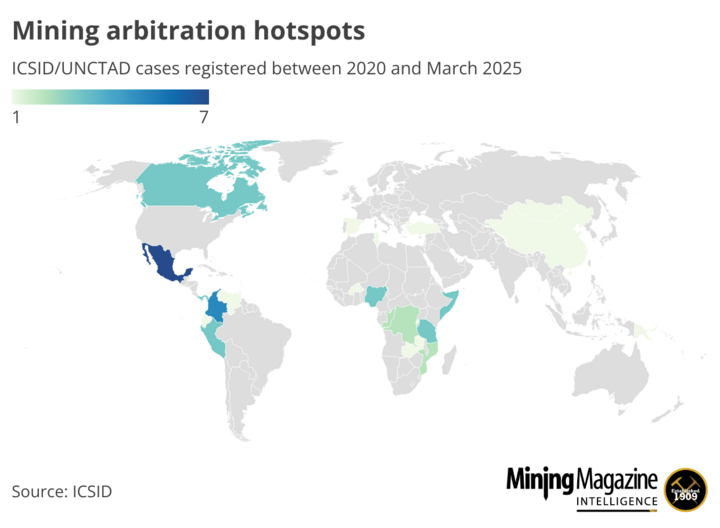

Mexico recorded the highest number of mining arbitration cases, with eight filed from 2020 to 2025.

The most recent case was brought last year by three subsidiaries of Ganfeng Lithium. Details of the claim were not given, but the Chinese company was advancing its Sonora lithium project prior to former president Andrés Manuel Lopez Obrador's (AMLO) nationalisation of lithium resources in 2022.

AMLO, a vocal critic of foreign mining companies, also pushed through a bill calling for a ban on open pit mining last year. New President Claudia Scheinbaum, who took office in October, has said she will review the proposal.

Arbitration hotspots: Colombia

Colombia was the respondent in five ICSID mining arbitration cases, the second-highest number after Mexico.

Colombia's mining sector faces security risks from armed groups and illegal mining. Zijin Mining subsidiary Continental Gold brought a claim against Colombia last year, stating that illegal miners, reportedly linked to the Gold Clan, had stolen an estimated 2t of gold from the Buriticá deposit, and hindered operations. The company argues the government has failed to prevent criminal incursions.

Arbitration hotspots: West Africa

West Africa has recently experienced a surge in arbitration cases.

Out of five cases brought to date in 2025, four relate to the region (three against Niger and one against Mali). One claim was also brought against Burkina Faso last year.

West Africa has seen a surge in investment risk, with Mali, Guinea and Burkina Faso all falling in the bottom D-rating for risk in MJI's World Risk Report 2024 feat. MineHutte ratings (rising risks in West Africa were discussed in MJI's free webinar in January).

Mali saw three cases registered, including one by Barrick Gold subsidiaries Société des Mines de Loulo S.A. and Société des Mines de Gounkoto this year. Barrick has suspended operations at its Loulo-Gounkoto complex in Mali following a dispute over taxes, in which several Barrick employees were detained by authorities last year.

Concerns have been raised over restrictive mining regulations imposed by the military-led government, which has also threatened to revoke mining licences.

Arbitration hotspots: Panama

Despite its small number of mining assets, a series of cases put Panama in the arbitration spotlight in 2024.

The country currently has three pending cases listed on the ICSID website, brought by Franco-Nevada, Orla Mining and Petaquilla Minerals last year.

First Quantum Minerals' US$20 billion claim, lodged in 2023 following the forced shutdown of its Cobre Panamá copper mine, is being handled by the International Chamber of Commerce.

The company has instructed its lawyers to suspend arbitration proceedings after President Jose Mulino authorised the sale of 120,000t of copper concentrate stored at the mine since the stoppage.

By Celia Aspden

Edited by Sam Williams

We would love to hear your feedback!

Please email sam.williams@aspermont.com with any questions, suggestions, or comments about our research.