There's no question that digital transformation is driving change in the mining industry. According to the recently published Connected Mining Solutions Market report by Berg Insight, digitalization of mining operations profoundly impacts production efficiency and safety.

However, the report notes confusion over the countless variations of expressions such as digital mine, connected mine, and smart mine. So, which is it? A philosophy? Or, a well-defined solution set?

What makes a mine smart?

All mines want to cut costs, increase productivity and, improve safety. I've met with more than 50 customers so far this year and it's not hard to see the industry looking for a more connected ecosystem of technologies. We're increasingly seeing edge devices capturing data and bringing it back to the office where it's transformed into information for more proactive decisions.

Mining automation beyond haulage and drilling

The Internet of Things, (IoT) cloud computing, artificial intelligence, (AI) predictive analytics and ultimately automation are all playing a role in this shift towards more connected ecosystems. And by automation, I don't just mean automated haulage or automated drilling. Automation goes all the way back to data acquired at the very beginning of the value chain and reconciled at the end: from geological modeling through to the execution of tasks and operations. Many companies are starting to execute on such data-management strategies, allowing them to access and gain more insight into their data.

In addition to obtaining more insight from data, companies are also focused on ensuring that data is secure. Cybersecurity is an increasingly hot topic in the industry, especially as mines adopt semi-autonomous and autonomous solutions. Change management becomes important here as companies grapple with the challenge of embracing technology not just in operations but within organizations, too.

"How do we bring our employees on this journey," is a question I'm increasingly asked. The answer lies in understanding social responsibility so mines not only leverage technology but ensure they bring their staff along with them.

Berg Insight's Connected Mining Solutions Market report lists no fewer than 26 tech firms that are attempting to solve mining companies' problems with technology. Yes, mining can be a niche industry with niche needs, but how does a technology company distinguish itself amid so much competition?

The importance of integrated mining technology

I believe there are a couple of ways to achieve this. One way lies in the ability to partner with a customer and deliver value with their existing technologies. Another rests on the ability to help integrate those technologies and connect planning to operations to safety to - ultimately - autonomy with a feedback loop throughout.

Any company delivering this integrated technology stack can separate itself from the pack and provide more value to its clients, especially when complemented with proven implementation and change management strategies.

An autonomously connected ecosystem means that when your radar system detects that you're about to experience a wall failure, trucks are automatically alerted to evacuate the area.

The keys to a smarter mine

We've all seen a trend towards autonomous vehicles. Obviously, ensuring our equipment runs 24/7, 365 days a year - or as close as possible to that - enables us to get the most out of what can be expensive assets. This has implications for productivity and safety. Reducing human interaction in a mine site is a high priority for many companies striving to make their operations safer and more productive.

When we focus on automation, it's not just about vehicles being able to travel from A to B. In a smarter mine, those vehicles need to connect within the full ecosystem of technologies. So, within one feedback loop, from end to end, we can know how our scheduling impacts our truck haulage, reconciliation and material flow.

We can then integrate other parts of the mining value chain within this process. For instance, our geo-technical monitoring system or radar system detects that we're about to experience a wall failure in a particular area of the pit. Within an autonomously connected ecosystem, that system must automatically connect to alert those trucks to evacuate the area.

Short-interval control

Mines must make decisions quicker, more proactively, and with the insight afforded by a full holistic picture of the mine. Short-interval control helps bridge those gaps between a strategic plan, a tactical plan, and execution of our tasks in moving material. Greater control at a sub-shift level delivers even greater insights and aligns company strategy with execution.

Our customers are seeing great benefits in this area from the integration of our scheduling solution and our fleet-management solution. The data produced by that connection can pay huge dividends when it comes to productivity.

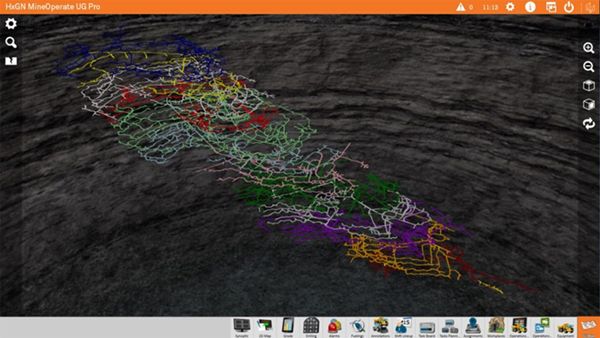

Connected devices are helping companies to locate and better understand asset performance underground.

The evolution of underground mining solutions

Technology companies have good reason to renew their focus on underground solutions. Minerals close to the surface are increasingly rare and underground mines tend to have a smaller environmental footprint. We're finding newer ways to extract minerals, both at the surface and underground. As we push underground, we will need to develop those technologies to suit different methodologies.

Block caving for instance, requires different technology needs and process needs compared to more traditional methodologies. The biggest challenge we've always had is connectivity and the means to actually run technology underground. How do we transfer data back to the surface to make the right decisions? You can't just step over the edge of the pit and see what's happening.

Hexagon is focusing on several areas, from automation to tele-remotes and more connected devices, to help mines locate their assets, understand what those assets are doing and when they're doing it. That way companies can get more from those assets.

An education in mining technology's benefits

Berg Insight's Connected Mining Solutions Market report notes that half the world's mines are simply not interested in investing in technology. Some are forced to re-evaluate that reluctance because of government legislation and shareholder scrutiny. Clearly, technology companies have a role to play in educating prospective customers to technology's benefits.

When we talk about partnering with clients, education is just one aspect. How do we bring our experience and knowledge to companies, so mines see where technology's benefits lie? Collision avoidance and vehicle intervention are just two examples of where Hexagon has helped its customers to see technology as an enabler. Companies have been able to not only meet tougher government legislation but also to make smarter, better decisions about improving safety and avoiding incidents.

‘Smart' depends on leveraging data and information from smart devices, smart connected devices, and IoT devices.

So, what makes a mine smart?

‘Smart' started as an acronym: self-monitoring analysis and reporting technologies. It's evolved into a buzzword and, as the Berg report notes, it can be confusing as to what it actually means. It's an exciting topic and one that will continue to evolve.

For me, ‘smart' elicits three main technologies: smart devices; smart connected devices; and, IoT devices. The smart part relies on leveraging data and information from those three technologies back into our organizations so we can make smart choices and better decisions in real time.

There's a huge opportunity within mining operations to develop these technologies. When it comes to smart devices and smart connected devices, a recurring theme among the clients I talk to is, "How do we get access to more of this data so we can look at it, analyze it, and make more proactive decisions?

IoT devices are what will allow us to pull all of the data from all of these different areas of an organization and start to look at trends using artificial intelligence. Once that ecosystem is established within our operations, we can make better, more proactive decisions.

That's when we can call our mine smart.

In our Thought Leader Series, Rob Daw discusses this topic and others here and in podcasts hosted at hxgnspotlight.com.

ABOUT THIS COMPANY

Hexagon Mining

Hexagon’s Mining division brings surveying, design, fleet management, production optimization, and collision avoidance together in a life-of-mine solution that connects people and processes.

HEAD OFFICE:

- 40 East Congress Street, Suite 300, Tucson, Arizona, 85701, United States

- Phone: +1 520 795 3891

- Web: hexagonmining.com