I have often encountered a problem they described in making decisions on key longwall equipment for underground coal mining.

It can be stated as follows: "How does one make the best choice of equipment, so that it is not expensive, but at the same time high quality?"

The most expensive of all longwall equipment for underground coal mining is the powered roof supports and the armoured face conveyors - they account for up to 90% of the cost of the entire longwall system.

A tender (procurement bidding process) for the purchase of this equipment is designed to solve the problem stated above.

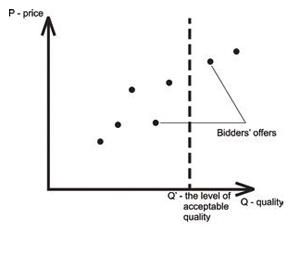

Let's look at Figure 1 (below) to understand the actions most equipment buyers take to try to solve this problem.

One way or another, buyers are trying to draw a line of acceptable quality. After that, the prices of those bidders that meet this quality are considered.

All the buyers are trying to do is move this line of acceptable quality, narrowing or expanding the list of bidders under consideration.

The finance or supply departments try to move this line to the left, and the technical or production departments try to move it to the right.

Usually, the more the line goes to the right, the higher the price. Of course, a quality product for a long-term project is very good, but:

- You do not really evaluate the quality of the equipment you purchase, but instead the quality of previous deliveries/references;

- As a rule, you pay the highest price during the tender, effectively excluding cheaper offers.

- Buyers have developed lots of tools to allow bidders with cheaper offers to participate, but, unfortunately, bigger doubts about quality arise in the tender process. To resolve these doubts, buyers have introduced:

- Extended warranty obligations;

- Financial responsibility for the warranty period;

- Bank guarantees for the warranty period, etc.

It is interesting that all these tools were invented by buyers in order to stimulate suppliers to ensure high quality, despite the fact that these tools were not directly related to quality.

A better solution here in, my opinion, is for the buyers to increase their level of knowledge about quality and learn how to control it.

The quality of the equipment depends on the following factors:

- Quality of design;

- Quality of materials;

- Quality of manufacturing

How can the buyer control all these aspects?

One solution is the buyer can start purchasing this quality control service from a company that specialises in providing it.

A Technical Audit employee carrying out UT Testing of the powered roof support's goaf shield for Raspadskaya project

Guided by this, I came to the idea of creating a company that provides technical-audit services for longwall equipment from design to manufacture for mining companies around the world.

Knowing the experts in the market, I selected the leading specialists and at the beginning of 2018, the Technical Audit company was formed.

The company staff included: former chief designer of DBT, Detlef Lettau; DBT designer, Wilfred Weigel; former production director of Eickhoff Bergbautechnik, Heinz Tenberge; as well as a group of certified specialists who perform non-destructive testing in accordance with international standards used for the manufacture of powered roof supports and armoured face conveyors.

The subject of our first order in 2018 was an audit of the production of a longwall system for the Denisovskaya mine, owned by Russian coal company KOLMAR.

The results were very impressive - the audit revealed many bottlenecks and areas for improving the quality of equipment during its manufacture. But, most importantly, the results of the audit clearly convinced the buyer of the high added value: for 1-2% of the cost of equipment (the approximate cost of the audit), the buyer received high-quality equipment.

The second positive was the increase in the quality of production from the manufacturers, which the manufacturers greatly appreciated and benefitted from.

A Technical Audit employee carrying out research for one of its projects

After such a clear, positive result, we received our next orders: for the audit of the longwall system at Russian coal company Sibirskaya's Uvalnaya mine, the audit of powered roof supports for Polish coal company LW Bogdanka, and a second longwall system audit for KOLMAR at its Inaglinskaya mine.

After the successful execution of our first projects, in early 2019, we were approached by the Raspadskaya coal company - Russia's largest coking coal producer, which has more than 20Mt/y of output.

Raspadskaya is a part of the large mining and metallurgical holding company EVRAZ.

Raspadskaya shared its thoughts with us concerning the purchase of the most expensive longwall equipment - powered roof supports.

The company had launched a tender process to select a supplier of the powered roof supports for its Uskovskaya mine.

At this point, it had two rather unattractive options: either buy powered roof supports from top global manufacturers at a fairly high price, or save money and buy powered roof supports from less well-known manufacturers and equipment of unknown quality.

Raspadskaya already had experience of the latter, having in 2012 purchased powered roof supports from the largest Chinese manufacturer. For seven years of operation, Raspadskaya had to spend significant funds on repairing these powered roof supports, as well as incur costs associated with equipment downtime.

The company was extremely disappointed with this experience and did not want to repeat the same mistakes, but also did not want to overpay for equipment from a big-name supplier or increase the budget of the investment project.

In fact, the task was formulated as follows: to develop an effective approach that will allow them to purchase high-quality powered roof supports at the lowest possible price.

As a result, during a detailed discussion and several days of work, we developed a solution that actually became a road map (see below) for the tender process and further implementation of the project for the purchase of powered roof supports.

As key mandatory requirements for each of the bidders in the tender process, we included a contract draft with the audit condition of all stages of realisation of the contract for compliance with the standard EN1804 and technical requirements.

Namely, audit of design documentation (including verification of the FEM calculations), audit of the prototype powered roof support production, cycle test audit of prototype powered roof support, and audit of serial production of the powered roof supports.

The contract with the selected supplier should also include a condition that the buyer hires a technical auditor who will audit all stages of the contract execution.

THEO BRECHMANN

CHIEF OPERATING OFFICER OF TECHNICAL AUDIT

January 2018-today

35 years of management experience

Experience as design engineer, service manager, sales director and CEO

Twenty years as a sales director for CIS countries at Eickhoff Bergbautechnik GmbH, Germany (until January 2018)

Expert in longwall mining technologies

In cases that come with a negative conclusion from the auditor (non-compliance with the terms of the contract in terms of the quality of manufacturing equipment according to technical specifications and standard EN1804) at any stage of execution of the contract before shipment, the buyer is entitled to cancel the contract and the supplier will be obliged to return the advanced payment and pay the buyer a penalty of 5-10% of the contract value.

Raspadskaya held a tender using this approach, which led to a 20% reduction in the cost of purchasing the powered roof supports, or about €6 million (US$6.8 million).

Currently, the project for the delivery of powered roof supports for the Uskovskaya mine is in the final stage - serial production is carried out very successfully under control of the Technical Audit company and Raspadskaya is very satisfied with the results.

It should also be noted that this approach can be used when purchasing any expensive equipment with a long service life.

If you would find this approach useful, and would like to reliably improve the quality of your equipment while also saving substantial costs, please feel free to contact us.

A road map for the tender and further execution of the project for purchasing powered roof supports developed by Technical Audit company and Raspadskaya coal company (EVRAZ).

1. Check the references: At the tender stage, the buyer invites tenders from powered-roof-support manufacturers with experience of international projects (not only domestic market) that comply with the EN1804 standard.

At this stage, it is important to evaluate the number and the quality of the references, getting feedback on the maximum number of international (export) deliveries over the past 10 years.

The tender participants must present to the buyer the reference list with contact details for each project of previously delivered powered roof supports and the buyer should send requests to these contacts asking for feedback that answers standard questions such as, or related to: Was the equipment delivered on time? Did you face any problems? Is the equipment currently operating? Are you satisfied with its performance? Did you experience any defects or faults during the warranty period or after? etc.

2. Contract draft with audit conditions and extended warranty period: The contract draft should include an extended warranty period: five years for the steel structure of the roof supports and three years for the power hydraulics of the roof supports, with the obligation to provide unconditional bank guarantees.

This should amount to 10% of the contract value for five years (to confirm the warranty for the steel structure of the roof supports) and another 10% of the contract value for three years (to confirm the warranty of the power hydraulics).

Before the start of face-to-face discussions, all invited participants must agree with the proposed contract draft.

3. A face-to-face technical stage: First, the buyer conducts a face-to-face technical stage where comments on technical proposals are openly issued and the bidders confirm their elimination and immediately make appropriate changes.

The goal of this stage is to consider and resolve technical comments in an open way and allow the maximum number of participants to participate in the next stage - the face-to-face commercial stage.

4. A face-to-face commercial stage: The buyer conducts a face-to-face commercial stage, where he/she can choose the cheapest offer. Having the contract draft with extended warranty obligations confirmed by bank guarantees, as well as points for audit of the manufacture of powered roof supports and the option of terminating the contract should the auditor issue a negative report, the buyer virtually eliminates the risk of supplying low-quality equipment, even at a low price.

Results

Raspadskaya used this approach and was able to conduct a very effective tender for the supply of powered roof supports, choosing the offer of one of the Chinese manufacturers and receiving savings of about 20%, or €6 million.

Currently, the contract for the supply of powered roof supports is being successfully executed, a positive conclusion has been obtained based on the results of load tests for 50,000 cycles in the independent TLO Opava laboratory and serial production is being carried out under the control of the Technical Audit company.

ABOUT THIS COMPANY

Technical Audit

HEAD OFFICE:

- Ul. Stadionowa 10,

41-400 Mysłowice, Poland - Tel: + 48 661 522 521

- Email: info@technicalaudit.pl

- Web: www.technicalaudit.pl