The time has come for Africa.

Let's not sugarcoat it: climate change has thrown the world for a spin. According to a UN report, climate-related disasters have increased by more than 80% over the last four decades. From devastating floods in South Asia to record-breaking wildfires in North America, the frequency and intensity of these events has pushed nations to rethink their strategies for combating the climate crisis.

For many countries, electrification has emerged as an obvious solution to this. Electrifying transportation, industry, and even homes reduces reliance on fossil fuels, thereby lowering greenhouse gas emissions.

On a recent trip to Finland (to visit an ABB factory trying to electrify industry), I was surprised when my nearly 70-year-old Airbnb host shamed an Uber employee for driving a fully petrol car. In Finland, electrification is not only policy, but it is a social expectation.

YOU MIGHT ALSO LIKE

In Africa, which hosts many of the minerals needed to fuel the electrification agenda, the solution is not quite as straightforward.

For centuries, the continent has suffered as foreigners extracted produce, minerals, and even people to add value elsewhere. Now, as the world clamours for cobalt, copper, and nickel, Africa is at a crucial juncture: how can mineral wealth translate into real benefits for people, and less harm to surroundings?

Extractive industries, mining included, have a legacy of environmental damage. In Africa, the industry is also coupled with a history of forced labour—something reflected in the present-day institution of artisanal mining.

For many governments, partnerships are a crucial piece of the puzzle. After all, most mining companies on the continent are foreign-owned. African countries need investment to exploit their resources, and foreign companies and governments have the money to finance this.

But in an increasingly multipolar world, governments are faced with a choice of who to partner with. Two obvious candidates emerge—the US-led West and China. And it is even more obvious who is winning government trust.

Chinese lead

China is leading the battery supply chain, in Africa and beyond. According to the International Energy Agency, the country undertakes "well over half" of lithium and cobalt processing, and "has almost 85% of global battery cell production capacity."

In Africa, China's presence is undeniable. According to CSIS, Chinese firms own or have stakes in 15 of the 19 cobalt-producing mines in the DRC, which supplies 70% of the world's cobalt, alongside substantial projects in Zambia, Guinea, Zimbabwe and South Africa.

The sheer scale of these investments has made China a dominant player in Africa's mining sector, causing panic among Western nations as the supply chain becomes increasingly monopolised.

"China has been the first to identify that they can use Africa to leverage their own position on the global stage," historian Duncan Money said to Mining Magazine. "We're really looking at a situation where China is on the front foot, and the Western countries are playing catch-up."

Infra wars

As the West scrambles to counter China's dominance in Africa's mining sector, one of its key strategies has been to invest in large-scale infrastructure projects. The logic is clear: by improving transportation networks, ports, and energy infrastructure, Western nations aim to create the necessary conditions for extracting and exporting minerals while also fostering broader economic development in African countries.

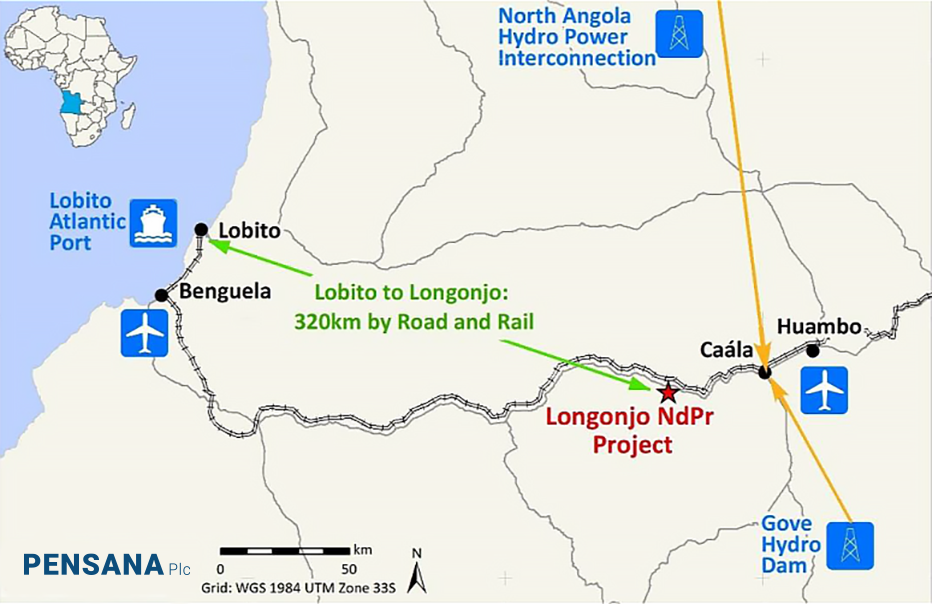

A prime example of this strategy is the Lobito Corridor, a railway project developed under the United States' Partnership for Global Infrastructure and Investment (PGII) initiative. The Lobito Corridor is designed to connect the mineral-rich regions of Zambia and the Democratic Republic of Congo (DRC) to the Atlantic coast via the Lobito port in Angola.

The PGII initiative, which serves as a counterweight to China's Belt and Road Initiative (BRI), has seen commitments of up to US$600 billion globally, according to the Atlantic Council. The Lobito Corridor is a significant recipient of this.

By providing a direct route to the Atlantic Ocean, the corridor offers an alternative to the often-congested routes leading to the Indian Ocean, enabling faster and more efficient export of minerals to Western markets.

Despite this investment, most countries around the Lobito Corridor are choosing to partner with China.

For example, Zambia has seen Chinese investments in its mining sector surge.

The Non-Ferrous Corporation Africa Mining PLC (NFCA), a China-Zambia joint venture, has invested US$1.5 billion in the country, with plans to increase annual copper production to 110,000 tonnes per year. The China Non-Ferrous Metals Mining Company (CNMC) also announced plans to invest an additional US$1.3 billion in Zambia's copper sector.

According to some reports, China is the main destination for Zambian copper exports. In the DRC, Chinese companies control 41% of cobalt production and around 28% of copper, according to UNCTAD.

Similarly, in the DRC, Chinese companies like China Molybdenum (CMOC) have made significant inroads, securing major stakes in cobalt and copper mining projects. CMOC acquired a 95% stake in the Kisanfu copper-cobalt mine in 2020, and a 80% stake in Tenke Fungurume, one of the world's largest copper-cobalt deposits.

Outside of the Lobito region, African countries are partnering with China through the BRI. In 2023, Africa became the largest recipient of Chinese BRI engagement, with a 114% increase in investments and a 47% increase in construction projects compared to the previous year, according to Green FDC.

Risk appetite

According to Money, China's lead in Africa can be chalked up to a higher degree of risk-taking.

"Infrastructure is a key area where China has made significant inroads, largely because they're willing to fund projects that are high risk," Money said. "The Chinese are willing to build infrastructure that doesn't necessarily yield immediate returns (...) If you want to compete with China, you have to be willing to take on similar risks."

A similar case is the ongoing development of Simandou, 'the world's largest mine.'

Rio Tinto secured exploration rights to the Guinean iron ore deposit in 1997, but the project faced consistent delays, partly due to Guinea's insistence on constructing a more challenging and costly railway within its borders, rather than exporting ore via the shorter route through Liberia.

Rio Tinto was unable to shoulder this risk, and eventually partnered with Chinese firms, including the Aluminium Corporation of China (Chinalco), Baowu Steel Group, and China Harbour Engineering Company.

Today, these companies are heavily involved in the development, with much of the ore extracted expected to be shipped to China for steel production.

Colonial era infra

Jonathan Offei-Ansah, a resource expert and founder of Africa Briefing, said that Western projects don't yield the same returns because many bear an eerie resemblance to colonial-era ventures.

"There is a very strong colonial legacy of infrastructure, which is mines and plantations to port," Offei-Ansah said. "The Lobito Corridor is going to do exactly that. No cross-border trade between Zambia and DR Congo; it's just from those countries out to sea. This infrastructure is being built to serve the needs of external powers. It duplicates existing patterns of economic dominance or what was historically coercion."

A quick glance at the Lobito Corridor website and a similar theme emerges.

Hailing the corridor as a route to African development, an article on the website states: "The Lobito Corridor establishes a westward path for the minerals providing optionality to producers and easier access to markets in the United States and Europe."

The vision is clear — African development will be achieved by shipping raw materials to the West.

Processing key

Despite its Western backing, the irony is that even the Lobito Corridor is expected to be predominantly used by Chinese companies.

"The first trial shipment in December (2023) from the Kamua (...) didn't go to a Western processing plant, it went to China," said Bryan Bille, principal policy analyst at Benchmark Mineral Intelligence.

"Despite the Lobito corridor being part of the US and EU supply diversification strategies, one could expect that future shipments will still likely go to China."

The use of railways like the Lobito Corridor depends heavily on who possesses the mineral processing capacity—a capacity currently concentrated in China, Money said.

"Western companies can mine lots of stuff in Africa, Southeast Asia, and so on. But where does this stuff go? It goes to China for processing because they're the ones with the capacity."

According to the Chatham House think tank, China's produced 72% of the world's refined lithium, and 68% of the world's refined cobalt in 2022.

A dual-pronged solution

While many Western companies and countries are beginning to invest in their processing capabilities, the industry is still lagging behind. A hurdle may be in the energy-intensive nature of processing.

"Most of Europe has just been through a massive energy crisis, and there isn't a big amount of extra energy around," Money said.

With this limitation, developing processing capabilities abroad could be a solution for Western countries seeking to diversify. Africa emerges as an obvious contender, especially since resources are already on the continent.

However, achieving this requires massive improvements in grid infrastructure and investments in processing plants.

"Historically, companies built their own infrastructure facilities," Money said. "They built their own hydroelectric dams, they've got coal-fired power stations, gas plants. Obviously, that adds costs to everything, and even now, mining companies are building solar power plants to service some of their needs, which can't be provided from constrained national grids."

Investing in processing, rather than simply extractive infrastructure, on the continent could be a two-pronged benefit for the ex-China supply chain.

By promoting genuine economic development on the ground, countries could strengthen their collaboration with African states for minerals while also diversifying the global processing supply chain.

"African governments are not passive actors in this relationship," the founder of South African mining service provider MAB group, Pinagare Mogodi, said as a reminder to global miners.

"They have agency and are making choices based on their own interests... and the future of African development will depend on how well African countries can leverage their resources for sustainable growth."