The mining industry knows that high pressure grinding roll (HPGR) solutions can offer improved grinding and energy efficiency, but the technology still faces challenges in achieving more widespread adoption.

HPGRs have historically faced issues with feed variance and segregation, leading to skew problems, and there are significant capex and service costs.

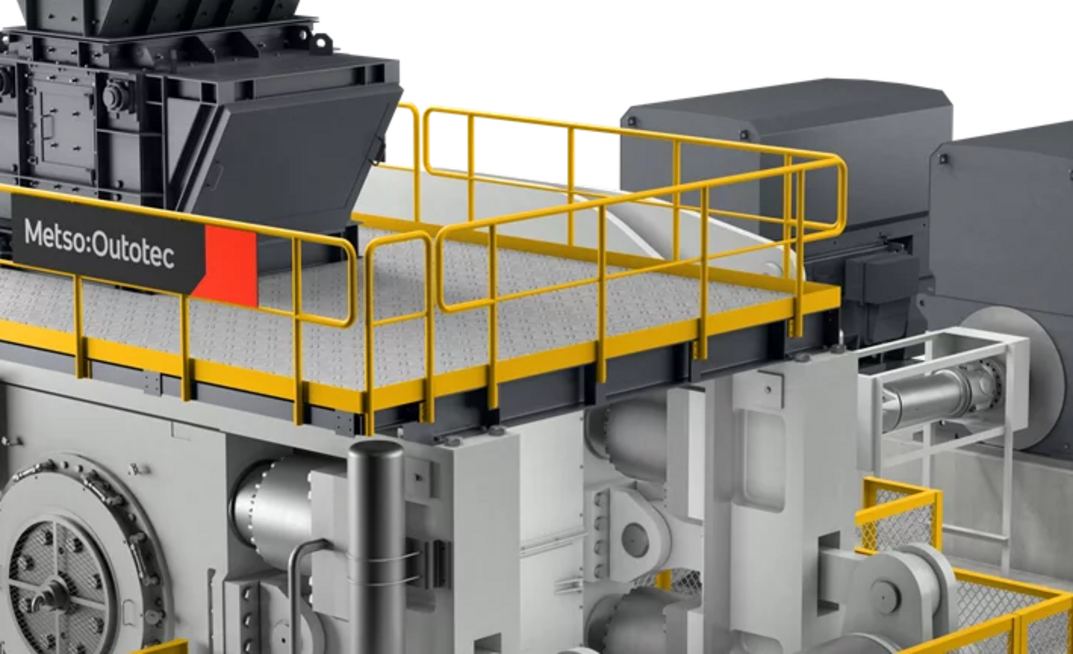

However, benefits down the road include lower future operational costs - and the advantage of pointing out to stakeholders that HPGR is among the most environmentally friendly mineral processing solutions. The latter is particularly the case when advancements such as Metso Outotec's HRCe technology are added into the mix.

Mining Magazine caught up with Christoph Hoetzel, Head of Metso Outotec's Grinding Business Line, to find out more about HPGR technology and its future.

Are there any enhancements to HPGR technology you expect to affect productivity (and power efficiency) in the next few years?

A major limitation of the efficiency of HPGRs is the reduced press force profile near the edge of the rolls, which can cause product to be nearly the size of the feed material. This is commonly referred to as the "edge effect". The major enhancements in HPGR technology are the Metso Outotec pioneered flanges, rotating side plates, which provide demonstrated increased productivity and energy efficiency by effective eliminating the edge effect.

The roll gap is more efficiently sealed as the flanges run very close to the opposite rolls edge (this is allowed for by skew suppression and increased stiffness) maintaining a more evenly distributed press force across the roll width. Metso Outotec's HRC with flanges has been proven to enhance HPGR circuit operation with overall finer product size gradation and the resulting reduction of circulating loads and energy consumption.

The flanges enhance the draw-in of material into the roll gap, resulting in a wider operating gap, reducing specific energy consumption and allowing for a larger top feed size, potentially benefiting up stream crushing.

Flanged roll service life greatly exceeds that of traditional HPGRs, due to the more evenly distributed pressure profile across the roll width, eliminating the "bathtub effect", which results from increased wear at the centre of the roll caused by the centrally peaking pressure profile of traditional HPGRs with cheek plates.

Further, the service life of the flanges is much longer when compared to traditional cheek plates, due to the flanges rotating with the roll, moving at the same speed as the material to be ground. In addition, the greater wear mass of the flanges extends the service life naturally.

Other enhancements for energy efficient comminution circuits are found when combining HPGR technology with other energy efficient grinding technologies, such as stirred mills.

Are HPGR only effective in controlled "dry" grinding applications?

The HPGR's efficiency is achieved by inter particle crushing, ie the press force is applied to a material bed allowing for multiple interparticle breakages within the high pressure/fracture zone. This requires a void volume into which the breaking material bed can be compressed and also friction between the particles to allow for press force application. Excessive or too little moisture negatively impacts this principle to function as it could reduce the ability to draw material into the roll gap and/or apply the press force to the particles.

Moisture content has an impact on wear too, as it varies the friction coefficient between the roll surface and material bed and also the embedment of the autogenous wear layer built-up on a studded roll. Some moisture is required but too much moisture can cause the autogenous layer to wash out.

Therefore it is necessary to consider feed moisture content when designing a HPGR circuit, however these limits are application specific and can't be answered broadly.

Given HPGRs potential advantages over other comminution types such as ball milling, why haven't we seen more takeup?

The evaluation process of when to use HPGR technology needs to consider feed and product particle size requirements, throughput, ore characteristics and economy of scale. When all these forementioned criteria allow for HPGR technology it is usually selected nowadays as it is an established technology.

Secondary crushing in combination with tertiary HPGR application, both in closed circuit configuration, potentially allows to substitute AG or SAG grinding when just considering particle size, i.e. getting a primary crushed ore down to a suitable size for ball mill grinding. For the selection other factors need to be considered, such as ore hardness and plant throughput. HPGR technology provides the greatest benefits for hard and very hard ores, for ores which are softer, AG or SAG milling can be the more economical solution due to the simplicity of the circuit, not requiring secondary crushing, screening and material handling to these individual processing steps.

Plant throughput can become a technology defining factor when individual equipment sizes are starting to push the economic and technical boundaries. In these cases it could be more viable to choose HPGR technology over AG or SAG milling, due to its high capacity and relative low power consumption.

To generalise, HPGR circuits generally become more commercially attractive for high throughputs, harder ores and climates with lower precipitation. As ore bodies are depleted, ores will become lower grade, requiring higher throughput comminution circuits. Water scarcity is a real licence to operate issue and energy efficiency will be a continued focus, even as the world moves towards cleaner energy production. Based on these megatrends, we see HPGR technology take up to gradually increase from the current levels.

Can you explain how HPGR technology can reduce water consumption within a plant?

Adoption of technologies that reduce water use and increase energy efficiency for Mineral applications is becoming more prevalent these days. As head grades continue to decline and projects correspondingly get larger, more innovative uses of these technologies is needed to support development that is financially viable as well as sustainable from the perspective of all stakeholders. HPGR technology reduces or eliminates water usage in their respective circuits as the process is dry. However, to judge the overall impact on a processing plant's water balance a holistic view should be taken considering all of its areas.

Why is it important that mining takes power consumption by comminution seriously?

Comminution processes consume a significant amount of the world's energy generated - equivalent to the power requirements of a large country. They also represent a large portion of the overall mining operation costs. Reducing the energy requirements for a mine by utilising energy-efficient technology is not only eco-efficient but lowers operational costs and raises shareholder value. Metso Outotec targets sustainability leadership in our industry by striving for a net positive impact on the globe and we are committed to the 1.5°C journey. Our Planet Positive Technology, including our HRC and Stirred Milling portfolio - which includes Vertimill, HIGmill, and SMD - are contributing to a more efficient and eco-friendly comminution.